An insured receives an annual life insurance policy, a unique and advantageous form of life insurance that offers a multitude of benefits and considerations. This comprehensive guide delves into the intricacies of annual life insurance, providing a thorough understanding of its purpose, coverage, eligibility requirements, and financial implications.

Annual life insurance stands out as a valuable financial tool, catering to specific needs and ensuring peace of mind for policyholders and their loved ones. By exploring the nuances of this insurance product, individuals can make informed decisions to safeguard their financial future and protect their families against unforeseen events.

1. Policy Overview: An Insured Receives An Annual Life

An annual life insurance policy provides coverage for a one-year term, offering a simple and flexible option for individuals seeking temporary life insurance protection. It ensures financial security for beneficiaries in the event of the policyholder’s unexpected death during the policy period.

Different types of annual life insurance policies include:

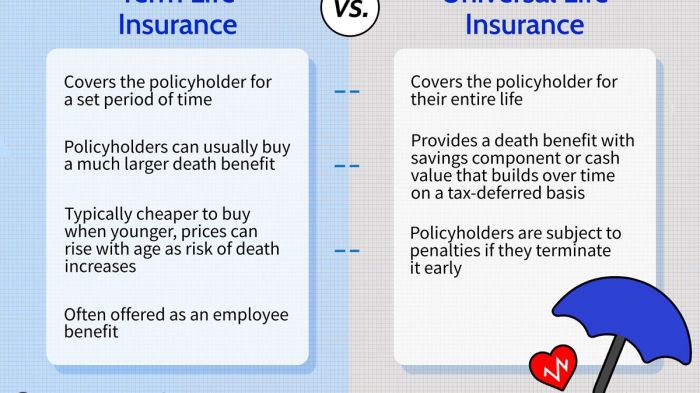

- Term life insurance: Provides coverage for a specific period, typically ranging from one to 30 years.

- Whole life insurance: Provides coverage for the entire life of the policyholder, as long as premiums are paid.

- Universal life insurance: Combines features of term and whole life insurance, offering flexible coverage and cash value accumulation.

Annual life insurance policies provide the following benefits:

- Affordable premiums compared to longer-term policies.

- Flexibility to adjust coverage amounts or cancel the policy at the end of the term.

- Peace of mind knowing that loved ones are financially protected in case of an untimely death.

However, annual life insurance policies also have some drawbacks:

- Premiums may increase with each renewal.

- Coverage is limited to the policy term, requiring renewal to maintain protection.

- May not be suitable for long-term financial planning or building cash value.

2. Eligibility and Application Process

Eligibility for an annual life insurance policy typically depends on the following factors:

- Age: Most policies are available to individuals between the ages of 18 and 85.

- Health: Applicants must be in good health or have acceptable medical conditions.

- Occupation: Certain high-risk occupations may affect eligibility or premiums.

The application process involves submitting a form with personal and health information, as well as undergoing a medical examination if required. Factors that may affect policy approval and premium rates include:

- Age and health history

- Tobacco use

- Family medical history

- Occupation and lifestyle

3. Premiums and Payment Options

Premiums for annual life insurance policies are calculated based on factors such as:

- Age and health of the policyholder

- Coverage amount

- Policy term

- Type of policy (e.g., term life, whole life)

Premium rates can vary depending on the insurance company and the individual’s risk profile. Payment options may include:

- Monthly payments

- Quarterly payments

- Semi-annual payments

- Annual payments

Discounts may be available for multiple policies or bundled coverage with other insurance products.

Query Resolution

What are the eligibility requirements for obtaining an annual life insurance policy?

Eligibility requirements vary depending on the insurance provider, but typically include factors such as age, health, and lifestyle habits. Insurers assess these factors to determine the level of risk associated with insuring an individual.

How are premiums calculated for annual life insurance policies?

Premiums are calculated based on several factors, including the policyholder’s age, health, coverage amount, and policy term. Insurers use actuarial tables and underwriting guidelines to determine the appropriate premium for each individual.

What are the benefits of annual life insurance compared to other types of life insurance?

Annual life insurance offers several advantages over other types of life insurance, such as guaranteed coverage for a specific period, flexible premium payments, and potential tax benefits. It provides peace of mind and financial protection for policyholders and their beneficiaries.