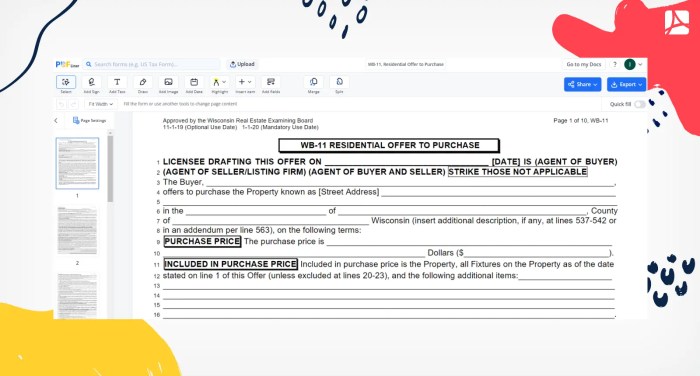

The WB 11 residential offer to purchase is a critical step in the home buying process, and understanding its legal implications, market dynamics, and negotiation strategies is essential for a successful transaction. This comprehensive guide provides an in-depth analysis of the WB 11 residential offer to purchase, empowering buyers and sellers with the knowledge and tools to navigate this complex process effectively.

The content of the second paragraph that provides descriptive and clear information about the topic

Market Analysis: Wb 11 Residential Offer To Purchase

The success of a “wb 11 residential offer to purchase” is influenced by current market trends and conditions. Analyzing these factors provides valuable insights into the potential performance of the offer.

The supply and demand dynamics, interest rates, and economic conditions play significant roles in shaping the market environment. An examination of these aspects is crucial for assessing the feasibility and attractiveness of the offer.

Supply and Demand

- Analyze the current housing inventory and the rate of new construction.

- Assess the demand for residential properties in the target area.

- Examine the impact of population growth, job market, and lifestyle preferences on demand.

Interest Rates

- Discuss the current interest rate environment and its impact on mortgage affordability.

- Analyze the historical trends and forecasts for interest rates.

- Consider the potential impact of interest rate changes on the demand for residential properties.

Economic Conditions

- Assess the overall economic conditions, including GDP growth, unemployment rates, and inflation.

- Examine the impact of economic conditions on consumer confidence and spending.

- Consider the potential effects of economic uncertainty or downturns on the residential real estate market.

Property Evaluation

Evaluating a residential property for purchase requires careful consideration of various factors to ensure a sound investment. This includes assessing the property’s location, size, condition, and amenities, as well as conducting a thorough inspection to identify potential issues.

Location

- Proximity to essential amenities (schools, healthcare, shopping centers, public transportation)

- Neighborhood safety and crime rates

- Future development plans and potential impact on property value

Size and Layout

Consider the number of bedrooms, bathrooms, and overall square footage. Evaluate the functionality of the layout, including the flow of space and natural light.

Condition

- Structural integrity and foundation stability

- Roof condition, plumbing, and electrical systems

- Interior and exterior finishes, including paint, flooring, and fixtures

Amenities

- Essential amenities (kitchen appliances, laundry facilities, parking)

- Additional amenities (pool, gym, security system)

- Impact of amenities on property value and desirability

Property Inspection

A thorough property inspection is crucial to identify any hidden issues or potential problems. Hire a qualified inspector to assess the following:

- Structural integrity

- Electrical and plumbing systems

- Roof condition

- Water damage or leaks

- Pest infestation

Negotiating a Fair Purchase Price

The purchase price should be based on the property’s value, determined by comparable sales, market conditions, and the property’s condition. Consider the following:

- Obtain a Comparative Market Analysis (CMA) to determine comparable property values.

- Factor in the cost of any necessary repairs or renovations.

- Negotiate based on the property’s condition and market demand.

Financing Options

Purchasing a residential property requires careful consideration of financing options. Understanding the various choices available, their advantages, and disadvantages is crucial for making an informed decision that aligns with your financial circumstances.

There are three main categories of financing options: mortgages, loans, and government assistance programs.

Mortgages

- Mortgages are long-term loans secured by the property being purchased. The borrower makes monthly payments that include principal (the amount borrowed) and interest (the cost of borrowing).

- Advantages: Lower interest rates compared to loans, tax deductions on mortgage interest, and the potential for building equity over time.

- Disadvantages: Requires a down payment, can have closing costs, and may involve private mortgage insurance (PMI) if the down payment is less than 20%.

Loans

- Loans are unsecured personal loans that do not require collateral. They are typically used for smaller amounts and have shorter repayment terms than mortgages.

- Advantages: No down payment required, quick and easy application process, and no PMI.

- Disadvantages: Higher interest rates than mortgages, no tax deductions, and can be more difficult to qualify for with a lower credit score.

Government Assistance Programs

- Government assistance programs provide financial assistance to low- and moderate-income homebuyers. These programs offer low-interest mortgages, down payment assistance, and other benefits.

- Advantages: Lower interest rates, down payment assistance, and flexible repayment options.

- Disadvantages: Income and asset limits, specific property requirements, and may require additional documentation.

Determining the best financing option for your situation requires a thorough evaluation of your financial circumstances, including your income, debt, credit score, and down payment savings. Consulting with a mortgage professional or financial advisor can provide personalized guidance and help you navigate the financing process.

Negotiation Strategies

Negotiation is a crucial aspect of the “wb 11 residential offer to purchase” process. Effective negotiation strategies can help buyers and sellers achieve their desired outcomes while maintaining a positive relationship. This section will explore effective negotiation strategies for both parties and discuss common negotiation tactics and how to counter them.

Negotiation Strategies for Buyers

Buyers should approach negotiations with a clear understanding of their goals, priorities, and financial constraints. Effective strategies for buyers include:

- Research the market:Gather information about comparable properties, market trends, and the seller’s asking price to establish a strong negotiating position.

- Be prepared to compromise:Negotiations often involve give and take. Buyers should be willing to compromise on certain aspects of the deal to reach a mutually acceptable agreement.

- Use a real estate agent:A qualified real estate agent can provide valuable insights, negotiate on the buyer’s behalf, and ensure the process is fair and transparent.

Negotiation Strategies for Sellers

Sellers should also prepare thoroughly for negotiations. Effective strategies for sellers include:

- Set a realistic asking price:Research the market and determine a fair price for the property to attract buyers and avoid protracted negotiations.

- Be flexible:Sellers should be willing to negotiate on certain aspects of the deal, such as the closing date or the inclusion of specific appliances.

- Use a real estate agent:A real estate agent can represent the seller’s interests, negotiate on their behalf, and ensure the sale is completed smoothly.

Common Negotiation Tactics and How to Counter Them

Both buyers and sellers may use certain negotiation tactics to achieve their goals. Common tactics and how to counter them include:

- Bluffing:One party may exaggerate their negotiating position to gain an advantage. To counter this, the other party should remain calm, ask for evidence to support the bluff, and be prepared to walk away from the deal if necessary.

- Intimidation:Some negotiators may try to intimidate the other party to get their way. To counter this, the other party should remain assertive, focus on the facts, and not be afraid to seek professional help if needed.

- Lowballing:A buyer may make an extremely low offer to start the negotiation. To counter this, the seller should remain firm, provide evidence to support their asking price, and be prepared to walk away from the deal if the offer is too low.

Tips for Reaching a Mutually Acceptable Agreement

To reach a mutually acceptable agreement, both buyers and sellers should:

- Communicate clearly:Open and honest communication is essential for successful negotiations. Both parties should express their goals and interests clearly.

- Be respectful:Treat the other party with respect, even if there are disagreements. This helps maintain a positive relationship and facilitates productive negotiations.

- Focus on solutions:Instead of dwelling on problems, focus on finding solutions that meet the needs of both parties.

Closing Procedures

The closing process for a “wb 11 residential offer to purchase” is a multi-step procedure involving the buyer, seller, lender, and closing agent. It culminates in the legal transfer of ownership from the seller to the buyer.

The closing process typically follows a specific timeline with important deadlines. The buyer and seller must be aware of these deadlines to ensure a smooth and timely closing.

Roles of Parties Involved

- Buyer:Responsible for signing the closing documents, paying closing costs, and taking ownership of the property.

- Seller:Transfers ownership of the property to the buyer, signs the closing documents, and receives the proceeds of the sale.

- Lender:Provides financing for the purchase and ensures that the buyer meets the loan requirements.

- Closing Agent:Facilitates the closing process, prepares and reviews closing documents, and disburses funds.

Homeownership Responsibilities

Homeownership involves significant responsibilities and costs that go beyond the initial purchase price. These include ongoing expenses such as mortgage payments, property taxes, insurance, and maintenance, which must be carefully considered and managed to ensure a successful and sustainable homeownership experience.

Budgeting and financial planning are crucial for managing homeownership expenses effectively. Creating a comprehensive budget that includes all income and expenses, including housing-related costs, allows homeowners to track their cash flow and make informed decisions about spending and saving.

Mortgage Payments, Wb 11 residential offer to purchase

Mortgage payments are typically the largest expense associated with homeownership. Homeowners must ensure they can consistently meet these payments, which typically include principal, interest, property taxes, and insurance (PITI).

Property Taxes

Property taxes are levied by local governments and vary based on the assessed value of the property. Homeowners must research and understand the property tax rates in their area and budget accordingly.

Insurance

Homeowners insurance protects against financial losses due to damage or destruction of the property. Homeowners should consider both homeowners insurance and flood insurance, if applicable, to ensure adequate coverage.

Maintenance and Repairs

Regular maintenance and repairs are essential to preserve the value and functionality of a home. Homeowners should establish a maintenance schedule, including tasks such as roof inspections, HVAC servicing, and landscaping. Unexpected repairs can also arise, so homeowners should maintain an emergency fund to cover these expenses.

Query Resolution

What are the key legal considerations in a WB 11 residential offer to purchase?

The WB 11 residential offer to purchase creates a legally binding contract between the buyer and seller, outlining the terms and conditions of the sale. It is essential to understand the implications of this contract, including the rights and obligations of both parties.

How can I evaluate the market conditions to determine the success of my WB 11 residential offer to purchase?

Analyzing current market trends, such as supply and demand, interest rates, and economic conditions, is crucial for assessing the potential success of your offer. This information can help you make informed decisions about pricing and negotiation strategies.

What are some common negotiation tactics used in WB 11 residential offers to purchase?

Negotiation is a critical aspect of the WB 11 residential offer to purchase process. Understanding common negotiation tactics, such as anchoring, concessions, and deadlines, can help you achieve a mutually acceptable agreement.